tax preparation fees 2020 deduction

Fees associated with tax preparation for the years in which you file your returns are not miscellaneous deductions and cannot be. Deducting Tax Preparation Fees on Personal Taxes.

What Are Itemized Tax Deductions Turbotax Tax Tips Videos

Publication 529 122020 Miscellaneous Deductions.

. 2 days agoThat mean paying out millions of legal feesand 10350000 in damageswith no tax deduction. 1 That fee covers a standard 1040 and state return with no itemized deductions. IR-2020-47 March 3 2020 The IRS reminds taxpayers that free tax help is available in-person at nearly 11000 volunteer.

For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. This means that if you own a business as a sole proprietor you are eligible for this deduction and can claim it on Schedule C. Filing Your Tax Return.

However the law is only valid from 2018 to 2025. However the big question is how do you write off your tax preparation fees. Tax preparation fees.

Medical expenses are tax deductible but only to the extent by which they exceed 10 of the taxpayers adjusted gross income. Can You Deduct Tax Preparation Fees 2020. Ad Your biggest refund or your tax prep fees back plus 100.

Congress will need to. CPA Professional Review. Comparative data on what other tax professionals are charging can be a useful guideline for.

1 online tax filing solution. Can You Deduct Tax Preparation Fees 2020. The IRS lets you deduct tax preparation fees in the year that you pay for them.

It was obvious the preparer wasnt sure where to put it on Schedule A Itemized Deductions and so. At Jackson Hewitt We Get You Your Biggest Refund Guaranteed. Only from Jackson Hewitt.

The deduction can be claimed on business returns for example on Form 1065 for a partnership or directly on the. Ad Prevent Tax Liens From Being Imposed On You. The average cost for a basic tax form preparation is about 220.

Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax. Tax preparation fees on the return. Average cost how to price your tax preparation services.

For most Canadian taxpayers the answer unfortunately is no. They arent the only litigants to face big taxes when they resolve a lawsuit. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners.

If youre an employee and you receive a W-2 in order to prepare your taxes the short answer is that you are no longer able to deduct your. Deducting medical expenses in 2020. Form 1040 ES Estimated Tax Vouchers.

But dont run off with that. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns. This means that if you.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Maximize Your Tax Refund. Americas 1 tax preparation provider.

Individual Income Tax Return. Tax Return Fee Schedule. Accounting fees and the cost of tax prep software are only tax-deductible in a few situations.

I recently saw a tax return for 2020 that showed the tax return deduction. Form 1040 page 1 and 2 not including state return 75. Legal fees are tax-deductible if the fees are incurred for business matters.

Check out these free tax return preparation options. Publication 529 - Introductory Material.

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Income Tax Preparation

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

How To Deduct Medical Expenses On Your Taxes Smartasset

Small Business Tax Spreadsheet Business Worksheet Small Business Tax Deductions Business Tax Deductions

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

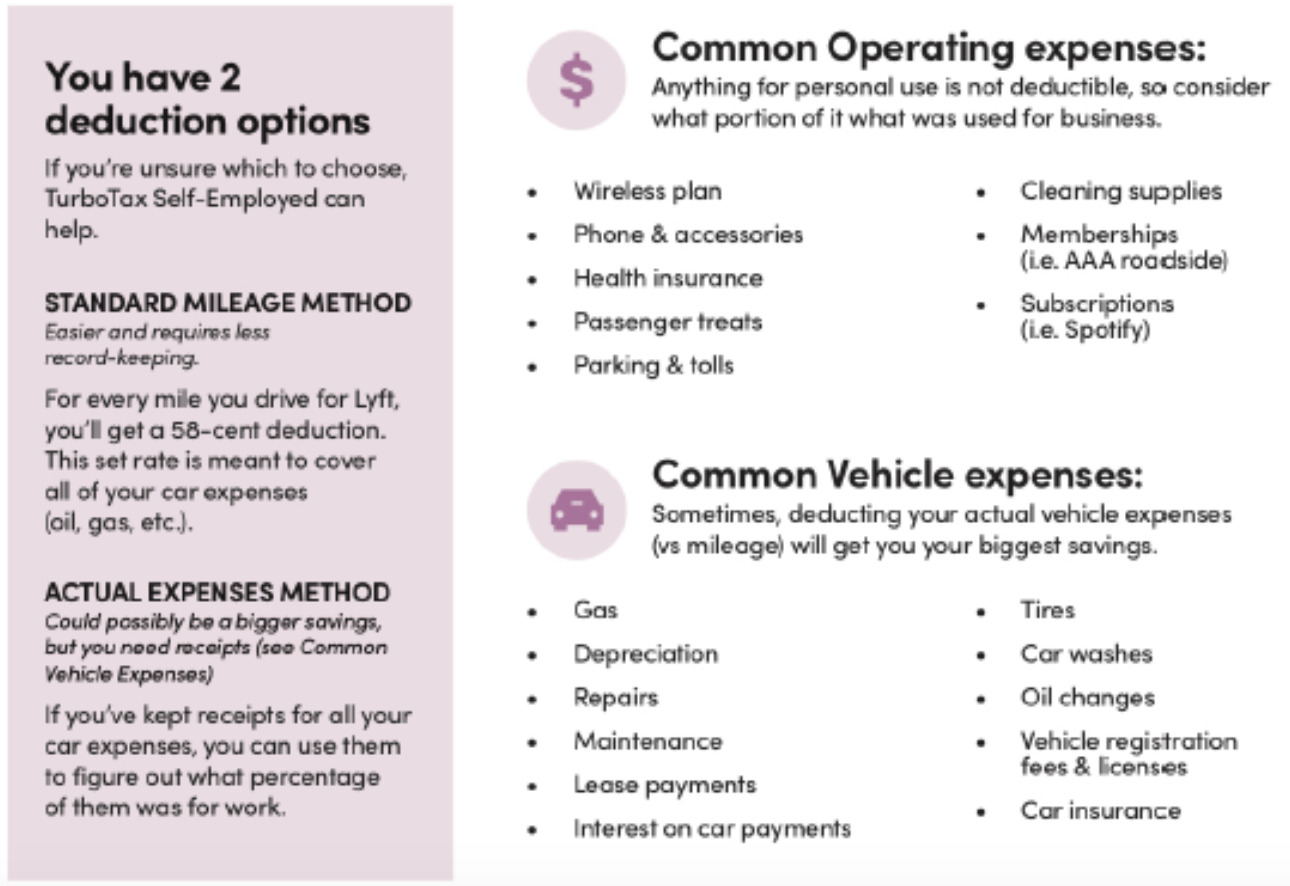

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Self Employed Health Insurance Deductions H R Block

Your Guide To 2020 Federal Tax Brackets And Rates

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

Difference Between Standard Deduction And Itemized Deduction H R Block